Layoffs, Terminations, or Furloughs for Employee Navigator Users

Layoffs and terminations are hard enough as it is. There are a few new features that have been released in our HR & Benefits Administration software from Employee Navigator to at least make the technology side easier. These features are designed to help your Employees, your Human Resources, and your Payroll teams adjust to the strain on employment statuses and payroll deductions.

First, let’s review the new “furlough” field

Being able to track an employee’s leave status is always helpful, especially if you need to run a report and check the employee’s length of leave. And, just like FMLA, military leave, sabbaticals, or other leaves of absences, you can now track furlough as a specific temporary leave status field.

And, what good is a field, if you can’t build a report.

I’ve built and shared an “on-demand” report with all of our Employee Navigator clients, but you can also build one in the “ad-hoc” reports in your own account. Generally for this report you will want to toggle on the fields for:

- First Name

- Last Name

- Office, Class, Department, Division, or Business Unit—depending on your filtering preferences

- Manager’s Name

- Employment Status — set this to “active” so you don’t pull through truly terminated employee records

- Leave Status

- Leave Start Date

- Leave End Date

- Phone (optional)

- Phone/Cell (optional)

- Address 1. Address 2. City, St, Zip

Here is my video walk-thru:

Next, we can look at new life events to allow for employee changes

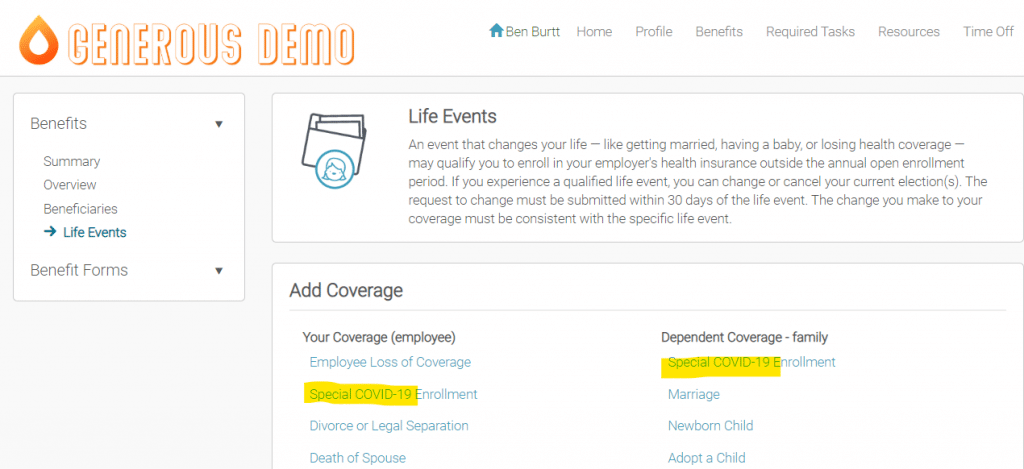

Some of our insurance plans are allowing for a new enrollment period for both employees and their dependents to add health coverage, if they have previously waived that option.

And, more commonly, we have employees with reduced hours or a new reduction in wages. This option has caused the need to enable new reasons to “drop” coverage or adjust an employee’s enrollment given the impact on their take-home pay.

You can enable these options in Employee Navigator’s Life Events menu. This is housed in the “Benefits” tab. Once enabled, the employee will be able to do Self-Service changes to their enrollment using the Add Coverage.

Here is my video walk-thru:

Now, here are the guidelines and best practices as put forth directly from Employee Navigator as of March 30, 2020

Processing Furloughs & Terminations as a result of COVID-19

Employee Navigator’s integrated ecosystem has many interconnected features with payroll providers, insurance carriers, Affordable Care Act, and COBRA TPA’s. As a result, improperly terminating or furloughing employees through Employee Navigator’s software OR through a payroll system that is integrated with Employee Navigator, could result in significant unintended, and possibly irreversible, damage to employee records. These incorrect employee or enrollment records could adversely impact current or future insurance enrollments, payroll deductions, 1095 processing, etc.

Therefore, we recommend taking some time to ensure you’re taking the proper steps in Employee Navigator’s software to ensure the initial outcome is correct and reduce the likelihood of issues when rehiring employees who have been impacted as a result of COVID-19. We have prepared the following information to help you avoid workarounds and ensure the smooth communication of enrollment changes to carriers and TPA’s as well as an orderly rehire process.

Special Enrollment Opportunity

Q. My health insurance company has granted a limited time COVID-19 enrollment opportunity. How should I process these events?

A. This limited enrollment opportunity will allow employees who previously waived medical coverage for themselves or waived medical coverage for their eligible dependents to either add coverage for themselves or their dependents.

Two new life events have been added to support carriers and employers who opted into this special enrollment opportunity. The life events are limited to medical and must be made “employee visible” by an admin user if the company has opted into this special enrollment period offered by their carrier. Participation is not required by the company or the employees. The default effective date of change will be 4/1/2020.

Layoffs vs. Furloughing employees

Layoffs are a result of the employer having no work for the employee, while a furlough is a mandatory suspension of work without pay. A furloughed employee will generally get to return to their job at some point after the leave of absence. As it relates to Employee Navigator and benefits, employees will fall into the following categories:

- Layoffs

- Furlough with benefits

Q. How should layoffs be handled?

A. Layoffs are processed as a termination with a reduction in force (COBRA) termination reason. This termination reason is a COBRA qualifying end reason, which means the employee will be eligible to continue coverage through COBRA. If an employer chooses to cover all or a portion of the employee’s COBRA premium, that arrangement would be made directly with the COBRA administrator.

Q. Should I furlough employees without benefits?

A. No, ending benefits for an employee is a COBRA qualifying event. The employee should be terminated in Employee Navigator. This will end the benefits and qualifying events will be processed for companies using integrated COBRA administrators.

Q. How can I track furloughed employees with benefits?

A. A furloughed employee who will continue to receive benefits, either paid by the employee through a reduced salary during the furlough period or paid by the employer for a specific period should NOT be terminated in Employee Navigator. This is especially important for those using integrated payroll. Payroll should NOT be terminating employment for a furloughed employee.

To properly track a furloughed employee, we added a “Furlough” leave status option to the system. This field can be found by going to the employee’s Profile, select Employment and select “Furlough” from the Leave Status option.

Coming Soon! This field will be importable and added to our Ad Hoc Reports on the next build scheduled. Employee Navigator will consider adding a feature to support adjusting the employer and employee contributions as it relates to 1095 reporting to account for employers who have paid the employee portion of the health insurance during a furlough. In the meantime, please track changes to the employer contributions for furloughed employees. This information will be needed in the future to properly update costs in Line 15 (monthly employee contribution for medical) for 1095 reporting.

At the end of the furlough period, should the employee not be able to return to work an assessment would be made to layoff the employee (process a termination in payroll and Employee Navigator) and offer continuation of coverage through COBRA.

Q. How can I track furloughed employee without benefits?

A. A furloughed employee without benefits is a terminated employee.

Q. Is the life event “Reduction In Hours” an acceptable way to terminate some but not all benefits for a furloughed employee? This employee is not being terminated from medical, dental, or vision, but is being allowed to drop Voluntary Ancillary benefits.

A. Yes, we recommend using a Life Event to drop non-COBRA qualified benefits that are being dropped due to a reduction in force. We also recommend tracking this change using the new Furlough status available in the employee’s profile.

Q. We are furloughing employees, and usually benefits end upon termination, but we want to extend them through the end of the month. How do I track this?

A. Again, a furloughed employee who will be experiencing a loss of coverage is a terminated employee. If the furlough causes a reduction in force that drops the employee below the full-time benefit eligibility threshold, the employee may be entitled to COBRA or State Continuation. Before extending coverage for this employee as severance:

- Check with your insurance company to ensure that you can make this change. This type of change may require you to amend your insurance agreement or to inform you carrier in writing. You’ll want to make sure your insurance carrier changes the setting in their computer system before processing the termination

- You should inform your COBRA provider of the change in termination rules

- Then terminate the employee’s coverage to trigger the proper COBRA qualifying event notice

Q. We are processing a lot of terminations, should I notify my COBRA administrator?

A. Yes, especially if you are using an integrated COBRA TPA with Employee Navigator. Many COBRA software systems will flag and reject large numbers of terminations once they meet certain thresholds, so we recommend letting your TPA know if you intend layoffs > 5% of your workforce.

Q. I am using an integrated payroll provider and want to terminate employment, but do not want to end their benefits. What should I do?

A. In reality you are furloughing the employees without pay, and not laying them off. This means you should not terminate them in the payroll system. If you enter a termination date in the payroll system, it will automatically terminate all of their benefits in Employee Navigator as well as integrated carriers. We recommend speaking with your payroll provider to determine the proper setting to use in the payroll system and recommend speaking with Employee Navigator’s support team if the integrated payroll provider instructs you to enter a termination date.

Q. We are not paying our employees and are not terminating them, but will keep them on their benefits, what should we do?

A. If you are not using an integrated payroll provider, you do not need to take any action in Employee Navigator. You can track these employees by indicating they are furloughed on the employee profile under “leave status”.

Q. We use an integrated payroll provider, and want to stop deductions for furloughed employees, what should we do?

A. This is generally a function of payroll. If the employees receive no pay, there is no income from with which to complete a payroll deduction, therefore, no action should be taken in Employee Navigator. You should contact your payroll provider to determine if there is a setting in their system which will stop the accumulation of payroll deductions. Meaning, you want to be sure that when the employee is rehired after missing 3 pay periods, that you do not take out all of the missed deductions on the 1st payroll after returning from furlough.

Q. How does the reinstate feature work in Employee Navigator?

A. Reinstate will unset the employee’s termination and plan enrollment end dates (if any) so that coverage is reinstated back to the employee’s original hire and coverage start date. IF YOU ARE CONNECTED TO PAYROLL, reconsider reinstate until you have contacted your payroll vendor. If an employee was termed in error or retracted their resignation and are terminated in the payroll system, the employee must be reinstated in the payroll system first.

Q. How does the rehire feature work in Employee Navigator?

A. Rehire allows you to enter a new hire date and will recalculate the employee’s eligibility for benefits based on their rehire date. Currently, the “New Hire” eligibility rule set on the plans will be used calculate the employee’s new eligibility date for coverage.

Q. Should I rehire or reinstate an employee?

A. Use Reinstate when the employee’s hire date did not change and when ended coverage should be reinstated back to the original coverage start date. Reinstating an employee essentially “undoes” their termination. Reinstate will also remove the COBRA event that was set on employees record when termination was entered.

Use Rehire if the employee was previously and legitimately terminated, had a break in employment, and will be eligible for new benefits now that they are re-employed with the company. Rehires will generally have a new enrollment window opportunity depending on the company’s enrollment window settings and the employee’s rehire date.

Q. We are measuring our Variable Hour employees using the Look Back Measurement Method in Employee Navigator. What do I need to know?

A. If a Variable Hour employee worked enough hours during their last measurement to be considered ACA Eligible for the current stability period, coverage must continue to be offered to the employee. Even if the employee is furloughed, this Variable Hour employee worked enough hours during in their previous measurement period to be offered coverage and they must be offered coverage for their entire stability period.